Spending Policy and Grant Budget

Overview

Spending Policy defines how much of a fund’s assets can be spent each year to stay compliant with IRS requirements. Foundations set up Spending Policy Codes, assign them to funds, and run annual calculations to determine each fund’s spendable budget, which is then recorded through Journal Entries.

Content

Spending Policy Code

Spending Policy Codes define how spendable amounts are calculated. A Spending Policy Code includes: Spending rate (e.g., 5%) Averaging method (e.g., average of ending balances) Number of quarters used for averaging (e.g., 12 quarters) Starting period/quarter for calculation

This allows foundations to calculate spendable amounts consistently across multiple funds using the same policy.

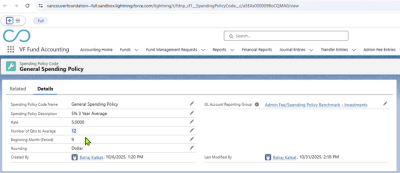

This screenshot shows a Spending Policy Code record configured with a 5% rate and a 12-quarter averaging period:

Fund-Level Spending Policy Assignment

Funds that are subject to Spending Policy are assigned a Spending Policy Code directly on the Fund record. Once assigned: The fund becomes eligible for Spending Policy calculations The fund will be included when a Spending Policy Entry is run for that policy category

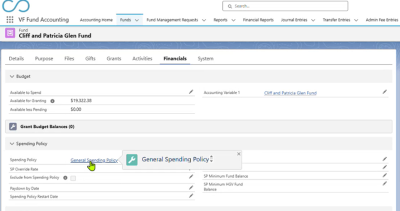

This screenshot shows a Fund record with a Spending Policy Code assigned:

Spending Policy Override Rate

While most funds follow a standard Spending Policy rate (e.g., 5%), some funds may require a custom rate. To avoid creating numerous Spending Policy Codes:

- An Override Rate may be defined at the Fund level

- During calculation, the system applies the override rate for that fund instead of the default policy rate

Example:

- General Spending Policy Code = 5%

- Fund Override Rate = 6%

- The fund’s Spending Policy Amount is calculated using 6%

This screenshot shows that if a Fund had a Spending Policy Override Rate, the field would be populated (in this particular example it is not):

Spending Policy Entry (Calculation Setup)

Spending Policy calculations are initiated from a Spending Policy Entry record. On the Spending Policy Entry:

- Select the Fiscal Year (e.g., 2025)

- Define the starting period/quarter

- Specify the number of quarters to include (e.g., 12 quarters)

- Choose the balance type (e.g., ending quarterly balance)

- Define fund selection criteria (policy category or individual fund)

- Enter Journal Entry details (Post Date and Description)

Although calculations are typically run for all funds under a policy category, they may also be run for a single fund.

This screenshot shows a Spending Policy Entry record configured for a 12-quarter calculation:

Spending Policy Calculation Results

After the Spending Policy Entry is processed, results are generated for each included fund. Results include:

- Current fund balance

- Average balance across the defined multi-quarter period

- Calculated Spending Policy Amount (rate × average balance)

The Spending Policy Amount represents the annual spendable budget for the fund. Not all fund assets are always considered spendable; Spending Policy determines the portion that may be granted.

This screenshot shows Spending Policy calculation results including current balance, average balance, and calculated spendable amount:

Spending Policy Journal Entry

Once calculations are complete, a Journal Entry is created to record the Spending Policy Amount in the general ledger. The Journal Entry:

- Is posted using the date specified on the Spending Policy Entry

- Includes Journal Entry Lines for each applicable fund

- Reflects the calculated Spending Policy Amount as the fund’s spendable budget

This Journal Entry provides the accounting foundation that supports grant budgeting and downstream grantmaking activity.

These screenshots show the button to create a Journal Entry and Journal Entry Lines created from a Spending Policy calculation:

Related Documentation

For full process details, object definitions, automation, and budget timing, refer to: